Guide to the CSRD

Corporate sustainability reporting directive

The Corporate Sustainability Reporting Directive (CSRD) is transforming how companies in Europe disclose their environmental, social, and governance (ESG) information. It replaces the Non-Financial Reporting Directive (NFRD), bringing more stringent standards for sustainability reporting. In this guide, we’ll explain the key aspects of the CSRD and how your business can comply with the new regulations.

Why the CSRD was Introduced

The NFRD, which required large companies to report non-financial data, lacked detailed standards, leading to inconsistent reports and greenwashing—where companies exaggerated their sustainability efforts. The CSRD fixes these issues by introducing stricter guidelines and making sustainability reports more comparable, transparent, and credible. The goal is to align businesses with the European Green Deal and the Paris Agreement, making corporate sustainability a central part of business operations.

Key changes in the CSRD

The CSRD introduces several major changes to sustainability reporting. It expands its scope to include over 50,000 companies across Europe, including listed and non-listed entities, small and medium-sized enterprises (SMEs), and even non-European companies with significant EU revenue.

A core part of the CSRD is double materiality, which requires businesses to consider two aspects:

- Financial materiality: How sustainability risks and opportunities impact the company’s financial performance.

- Impact materiality: How the company’s operations affect society and the environment.

The directive also requires companies to follow the European Sustainability Reporting Standards (ESRS). These standards cover a wide range of topics like climate change, human rights, biodiversity, and governance. This ensures that all businesses provide the same level of detailed and comparable information.

In addition, the CSRD requires external assurance for sustainability reports. This means that reports must be audited by independent third parties, similar to financial audits. Over time, the level of assurance will increase, ensuring even greater accountability.

Finally, all reports must be digitally formatted using XBRL (eXtensible Business Reporting Language). This will make reports machine-readable and easily comparable through the European Single Access Point (ESAP), which is expected to launch by 2027.

Steps to Comply with the CSRD

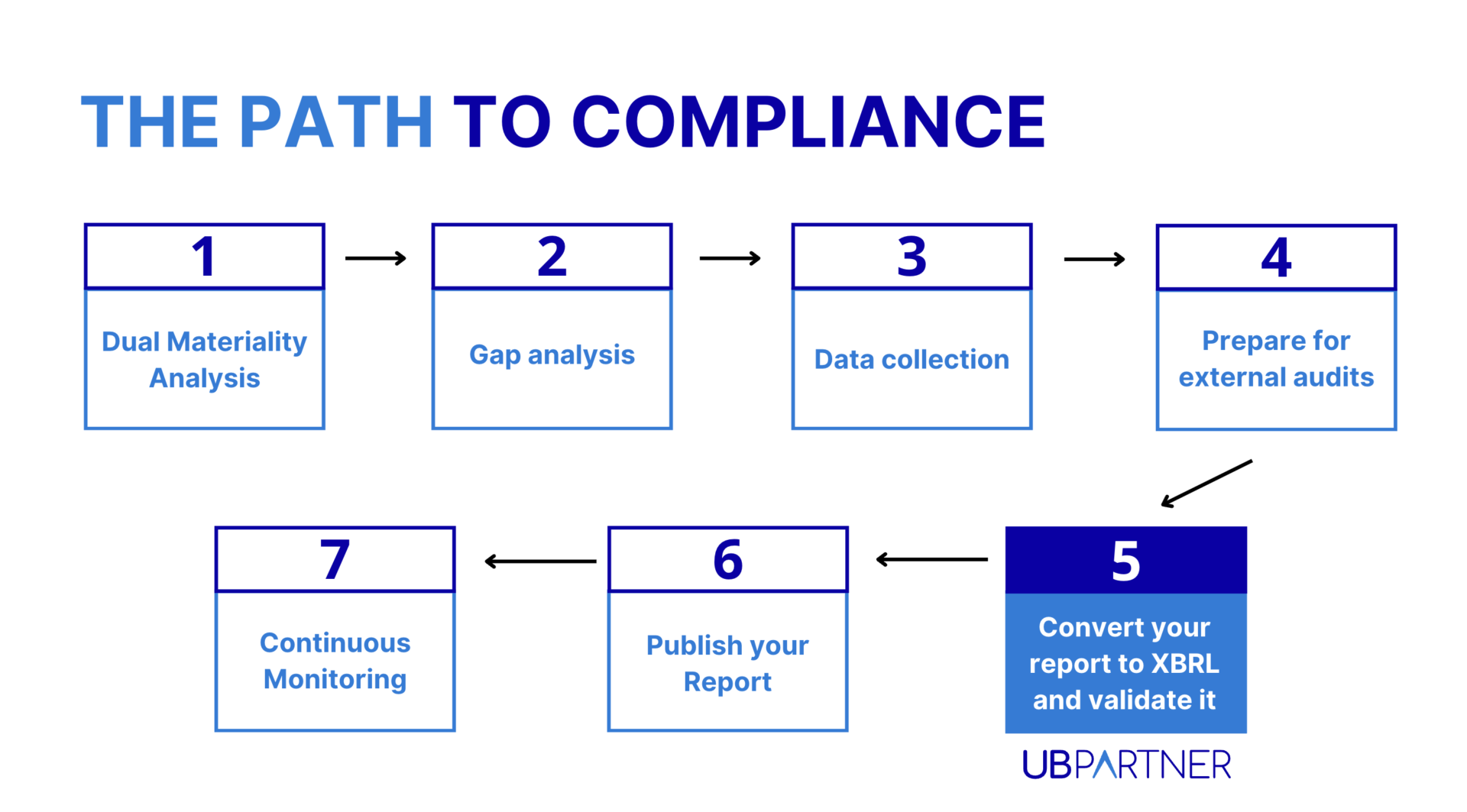

Here’s how your business can prepare for CSRD compliance:

- Double materiality assessment

Start by conducting a double materiality analysis. This means assessing which ESG factors impact your company financially and how your operations affect the environment and society. Talk to stakeholders, such as employees, customers, and investors, to understand the most important sustainability issues. - Gap analysis

Perform a gap analysis to see how your current reporting and sustainability efforts compare to CSRD requirements. This will help identify where improvements are needed, such as updating policies, gathering additional data, or formalizing sustainability actions. - Data collection

Collecting and managing ESG data is one of the most important steps. Ensure that data is gathered from across your organization, including different departments, locations, and supply chains. Using automated tools, can simplify the process by connecting directly with your existing systems. - Prepare for external audits

Since CSRD reports will be externally audited, it’s important to create a clear audit trail for your ESG data. Make sure all information is traceable and well-documented, so it’s easier for auditors to verify your report. - Convert your report to XBRL and validate it

Once your sustainability report is compiled, it needs to be converted into the XBRL (eXtensible Business Reporting Language) format. This standardized format ensures digital compliance with the CSRD’s reporting requirements. Validate the XBRL file to ensure all data is accurate and adheres to the regulation’s digital standards. - Publish your report

After validating the report, it should be included in your annual reporting and made accessible to the public. Make sure the report is formatted correctly and easily understandable for stakeholders. - Continuous monitoring

After publishing, you will need to continuously monitor your ESG performance to ensure compliance with the CSRD over time. Regularly reviewing your data and updating your practices will help improve your sustainability performance year after year.

When does your business need to comply?

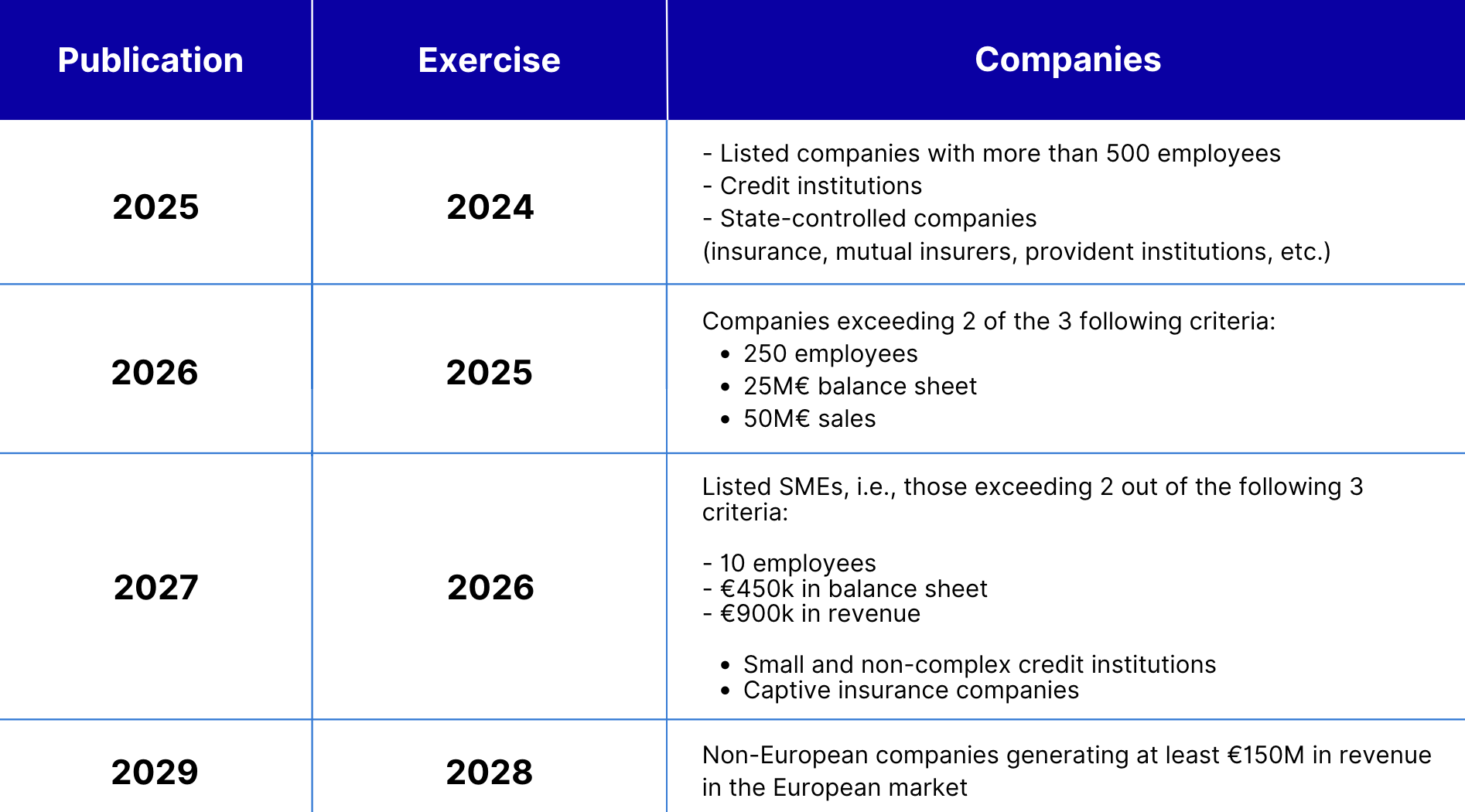

The CSRD’s compliance deadlines are phased to give businesses time to adapt:

- By 2024, large companies that were already covered by the NFRD must comply.

- By 2026, other large companies, including non-listed ones, must comply.

- By 2027, SMEs and smaller companies will need to comply.

- By 2029, non-European companies with significant EU operations must comply.

This gradual rollout gives companies time to get ready, but it’s important to start preparing as soon as possible.

The benefits of the CSRD

While the CSRD introduces new reporting requirements, it also presents significant opportunities for businesses. Complying with the directive can help companies:

- Enhance transparency with investors and stakeholders by providing accurate and verified ESG information.

- Build trust by demonstrating a genuine commitment to sustainability, improving brand reputation.

- Attract investment, as ESG-conscious investors increasingly prioritize companies with strong sustainability practices.

Additionally, by focusing on sustainability, businesses can future-proof their operations, manage risks more effectively, and align with global climate and social goals.

Conclusion

The CSRD represents a major step forward in corporate sustainability reporting. Its standardized framework, external audits, and focus on double materiality ensure that companies provide clear, comparable, and reliable ESG information. For businesses, now is the time to act. Preparing for compliance not only ensures you meet regulatory requirements but also strengthens your company’s sustainability efforts and builds stronger relationships with stakeholders.

Read more about CSRD :